Managing the Cost Structure

An organization’s Net Income Statement always has a line item called Cost of Goods Sold (COGS), the “direct costs of producing the goods sold by a company.” This sounds simple and pretty straightforward; however, capturing all costs can be a challenging process.

Actual costs are both direct and indirect. Measurable as well as indirect and not readily measurable. For example, a product has a bill of materials that can be accurately determined unless one has to factor in some of the supply chain problems organizations are currently facing. Raw component shipment delays have a cost. Employees and suppliers must be paid and even if the firm has a layoff, there are downsizing costs as well as rehiring costs.

Depending on the product/service line these costs can be substantial and are a component of the cost structure. COGS is only the surface of the cost structure iceberg.

Total Costs

In addition to COGS, organizations have many others costs that factor into the bottom line. Examples include, Advertising, Bad debt, Commissions, Depreciation, Employee benefits, Furniture and equipment, Insurance, Interest expense, Maintenance and repairs, Office supplies, Payroll taxes, Rent, Research and development, Salaries and wages, Software, Travel, Utilities, Web hosting and domains among Others.

Another point, as listed above in addition to employee salaries there are costs associated with employees. Often referred to a ‘Fully Burdened,’ this is to total cost of a laborer. For example, this includes payroll taxes, office space, benefits and event the HR costs necessary to support the labor force.

So, How To Structure Costs?

Business have two fundamental types of costs; fixed and variable. As one might expect, fixed costs are hard and not easily changed. For example, an office with a five year lease or even purchased outright.

Variable, provide more latitude in that they can be turned off and on with little or no notice or detriment/penalty. However, because of their nature, equivalent variable costs are often higher than a similar fixed cost, i.e., employee vs. contractor.

Most organizations will use a combination of fixed and variable, including ‘offshoring’ such as manufacturing in low cost counties or software development. Keep in mind that Intellectual Property (IP) may be at risk with certain offshoring. Caveat Emptor!

The cost structure of an organization is critical to its high performance. Executives need to be very mindful of how their firm’s cost is structured and the ramifications (including unintended consequences) of that decision. Finally, this is not a one time process but may dramatically change as the business environment shifts.

Being Lean

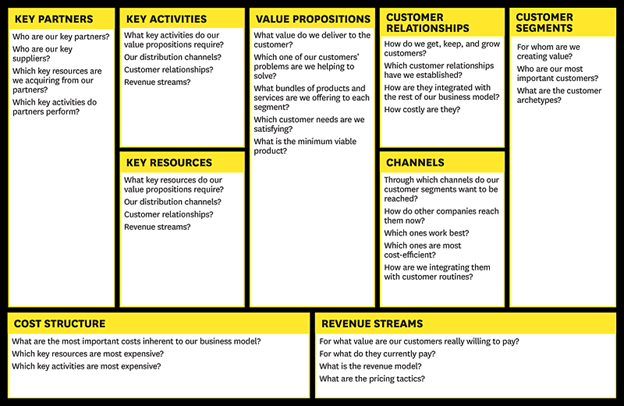

The Lean Canvas model previously discussed asked three key questions:

- What are the most important costs inherent to our business model?

Most will say that people are the most expensive cost and there is some truth that expectation. However, for some organizations R&D maybe the most important focal point, i.e., commercial space travel.

- Which key resources are most expensive?

Keep in mind that these can include external sources as well as internal. For example, many real estate investments include third party partners for funding.

- Which key activities are most expensive?

As an example, historically, software businesses have two major 50/50 expenses; development and sales/marketing. Once the product is developed, selling is the most expensive process. Where an organization is in the lifecycle may determines this metric.

Bottom Line(ish)

Costs may be the largest contributor to either a positive or negative bottom line. Top line Revenue is great but if the organization’s costs are not aggressively managed, value may be destroyed. Cost management is in the detail.

If a restaurant can save a fraction off each meal severed, over a year that is a significant contribution to profits. If a technology firm with higher margins does likewise its multiples upon exit may provide investors and founders with a much higher return.

Cost Management and Cost Structure are two different but similar managerial tools. Understanding how to effectively use them is critical to a profitable and successful enterprise. It is CRITICAL that all organizations, especially start up firms understand their cost structure and aggressively manage it. In the ESG era, cost management is the responsible thing to do. It assures sustainability and all the value add to society and stakeholders that flows from the firm.

The company now known as ExxonMobil was founded in 1882. One of their ongoing focus throughout many oil boom bust cycles was cost management. Most recently, the firm posted $23 billion in earnings for 2021. Cannot deny success.

One last thought. If your firm is in a sector where the price point of deliverables (revenue) is ‘commodity’ like, i.e. retail, energy or highly regulated, i.e. power generation then cost management is more important than top line growth. This component of the Lean Canvas is one of the most important.

Is your firm aggressively managing costs? If not why?

Next Time: Let’s talk about revenue.